Deductibility of expenses associated with the home office for employees who were forced to work remotely (telework) in 2020 because of government measures associated with the covid-19 pandemic.

1. Expenses associated with the home office VS other expenses:

It is important to distinguish between these two categories of deductible expenses in order to understand how to deduct these expenses.

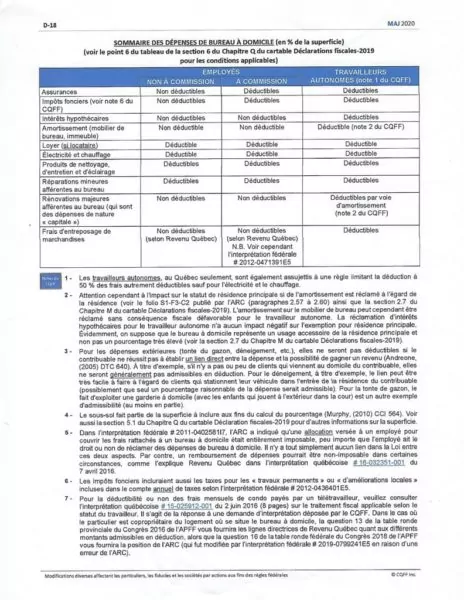

Home office expenses are new for 2020 and the list of these expenses is expressly established by both the federal and provincial governments. You cannot be imaginative. The deductible expenses associated with the home office are pre-determined. To find out what these expenses are, you can consult the attached table.

The other deductible expenses are the classic deductible expenses that you have always deducted, for example: gasoline, purchase of office supplies, internet service, etc.

2. Deductibility of expenses associated with the home office:

Governments offer you two ways to deduct these expenses, new for 2020:

2.1. Simplified method: If you have been required to work from home for a minimum of 4 weeks during the year 2020, you can take advantage of the simplified method of deducting expenses associated with the home office. This method, let’s call it the “$ 400 method,”

s allows you to deduct $ 2 per day of teleworking up to a maximum of 200 days during the year 2020, for a maximum amount of $ 400 for the year 2020. Obviously, you can only claim this $ 2 for the days of telework that you have done, 200 days is the ceiling (28 days being the minimum floor required to be able to take advantage of this method), so if you have done 100 days of telework during the year 2020 , you are entitled to deduct $ 200.

Note that this method does not require any proof, neither of expenses nor of teleworking, it is based on the good faith of the taxpayer although the government can always proceed to verifications at a later time.

2.2. Classic method: Instead of using the simplified method, you can proceed in the ordinary way and obtain from your employer the form T2200 / T2200S and its provincial version, signed. By signing these forms your employer certifies that you were required to work from home and use your home office. Then you, yourselves, it is not up to your employer to calculate your expenses associated with the home office. You must take your bills (electricity, renovations, etc.) and calculate your annual expenses for your building and a percentage of this amount will be deductible from your income. The percentage is calculated based on the area of your home office compared to the total area of your building. The basement is included in the total area. Be careful, however, it is very unlikely that a percentage that exceeds 15% is really possible …

The advantage of this classic method is that you can, in addition to the expenses associated with the home office, deduct the other deductible expenses mentioned above, the classic deductible expenses.

However, you cannot use both methods. If you choose the simplified method you can no longer deduct other deductible expenses.

If you choose the classic method, you lose the right to the simplified method.