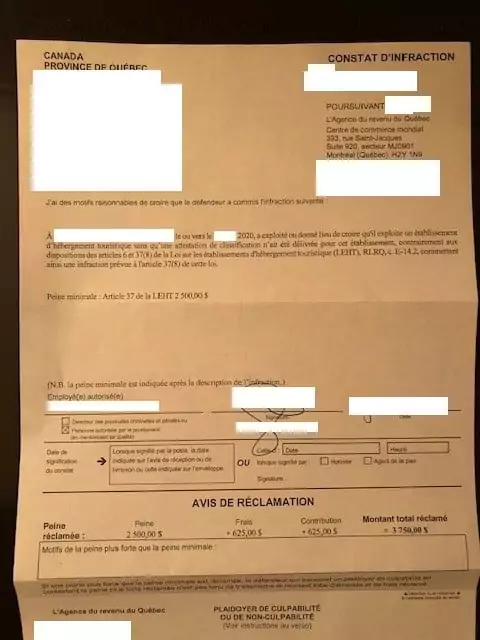

If you are renting a property in Quebec for a short period (a chalet, an apartment, a house, even a room in your main residence) you must ensure in advance that all the formalities have been completed. Otherwise, there may be an unpleasant surprise in the form of the attached letter that fines you $ 3,750. Note that this fine is imposed automatically, without notification or prior verification.

To avoid fines, here is the procedure to follow BEFORE starting the rental.

1. Obtain a license and pay around $ 300 in state fees. Here is a link to a website where you can find information on the procedure.

https://www.quebec.ca/…/hebergement-touristique-courte…/

2. Check if you need to get accommodation tax numbers.

If you offer accommodation units for rent only through digital accommodation platforms (e.g. Airbnb) operated by persons registered with the tax on lodging and these persons receive all the sums in return for renting these units, you are not required to be registered with this file.

On the Revenu Québec website you will find a complete list of all digital platforms registered in the lodging tax file.

https://www.revenuquebec.ca/…/taxes/taxe-sur-lhebergement/

Otherwise, you are required to receive the tax numbers on lodging, to collect the 3.5% tax of the amount received in consideration for the rental and to remit the taxes thus collected to Revenu Québec.